Life at Volt

‘This is a tectonic movement’: Tom Greenwood unpacks our Series B raise

Our Founder & CEO discusses what the funding means for Volt’s immediate priorities and long-term mission.

Open banking

Variable Recurring Payments: what are they and how do they work?

We demystify VRPs and set the record straight about this exciting technology’s current state of play: and what comes next.

Customer stories

Chalinga: ‘Pix positions us as a travel industry innovator’

The Brazilian travel agent has recorded record-breaking sales since switching on Volt’s Pix solution in January 2023.

Open banking

Open banking and fraud: A response to the UK government’s new Fraud Strategy

The announcement is a welcome indication that online payment fraud is being treated as a political priority.

Open banking

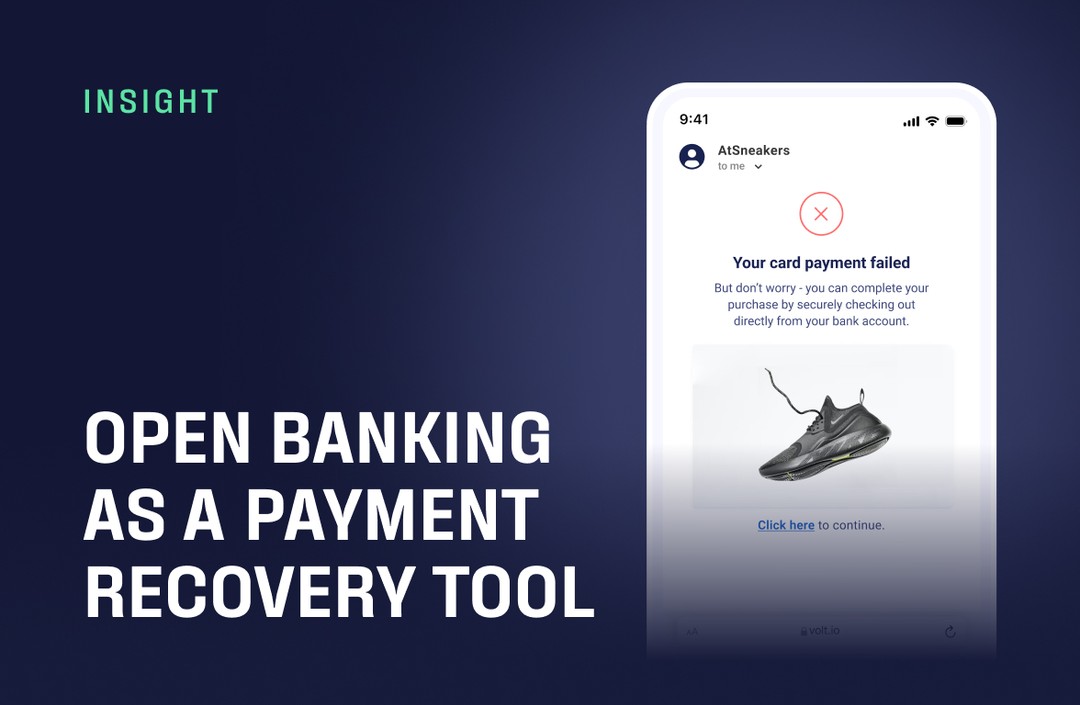

How Pay by Bank can reverse the impact of card declines

Learn how open banking payments can be a highly effective recovery tool for failed debit and credit card payments.

Life at Volt

Meet the women leading the charge at Volt

What better way to celebrate International Women’s Day than to shine a light on the women at the heart of our success?

Open banking

Scraping to orchestrating: The three waves of open banking

Screen scraping marked the first wave of open banking, but a lot has changed since those distant pre-PSD2 days…

Open banking

2023 open banking predictions: Stuart Barclay, VP Strategy

From adoption and regulation to consolidation and education, our VP Strategy shares his predictions for the new year.

Open banking

Open banking refunds: How do they work?

Open banking payments can be refunded, but it’s been up to third parties like Volt to build the required infrastructure.

Open banking

Instant payments in Europe will be the ‘new normal’

After the EC’s landmark announcement, our Founder and CEO unpacks the impact of continent-wide instant payments.

Open banking

How can PSPs seize the open banking opportunity?

By implementing open banking, PSPs can fulfil their duty of offering robust, inclusive payment options to their clients.

Payment innovation

Embedded checkout: Let customers pay on your website

Fewer redirects and less friction, coupled with a localised payment experience, means shoppers are more likely to convert.